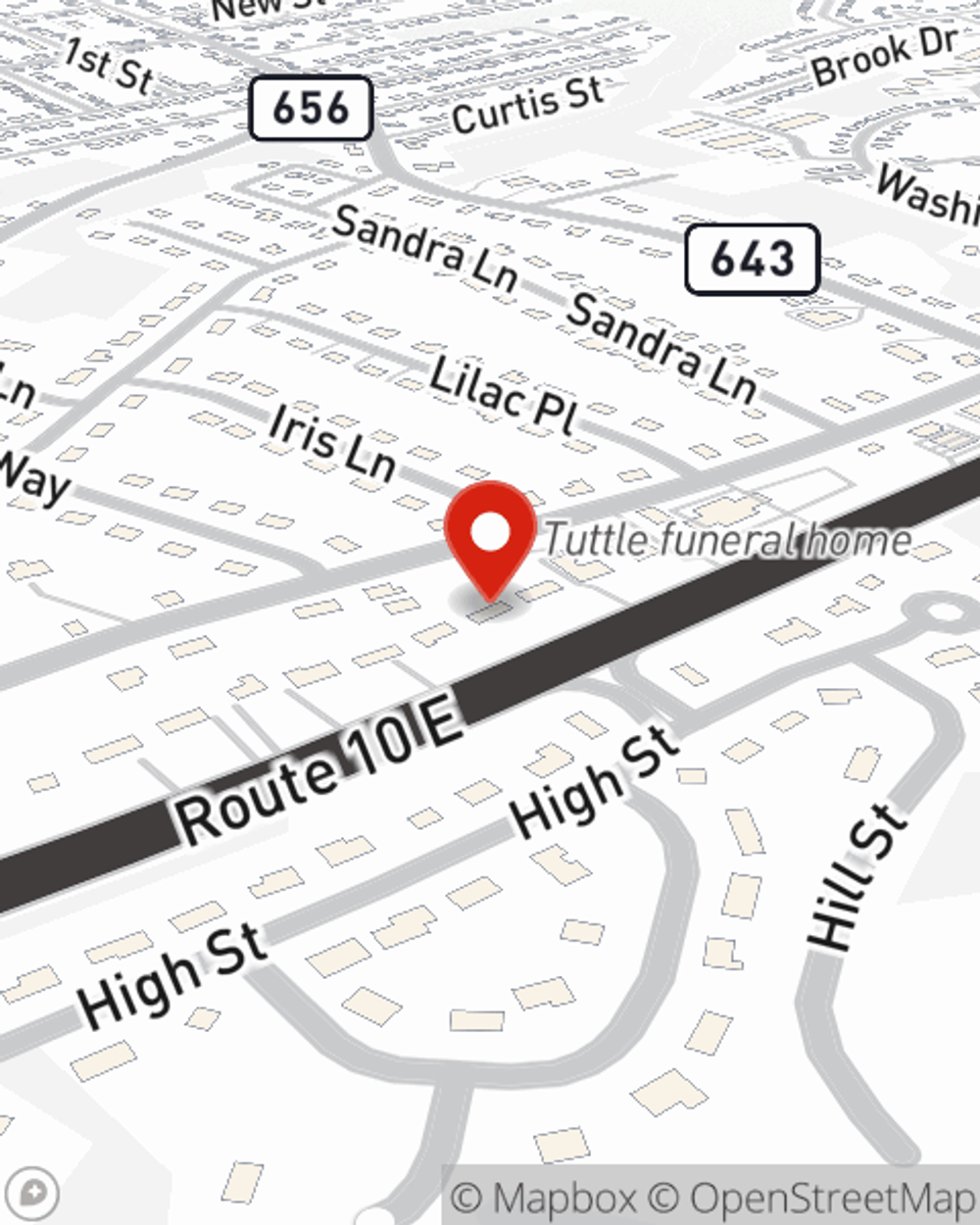

Business Insurance in and around Randolph

Get your Randolph business covered, right here!

No funny business here

- Randolph

- Roxbury

- Dover

- Denville

- Rockaway

- Netcong

- Chester

- Wharton

- Mine Hill

- Morris Plains

- Hopatcong

- Flanders

- Parsippany

Help Protect Your Business With State Farm.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all alone. As someone who also runs a business, State Farm agent Erin Misurelli understands the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to learn more about.

Get your Randolph business covered, right here!

No funny business here

Keep Your Business Secure

Whether you are a dog groomer a barber, or you own a janitorial service, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent Erin Misurelli can help you discover coverage that's right for you and your business. Your business policy can cover things such as computers and buildings you own.

Contact the exceptional team at agent Erin Misurelli's office to learn more about the options that may be right for you and your small business.

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Erin Misurelli

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.